The Benefits of Credit Card Reward Programs

Understanding Credit Card Reward Programs

Credit card reward programs have garnered immense popularity among consumers, providing them with an excellent opportunity to maximize their spending potential. By participating in these programs, individuals can leverage their everyday expenses into meaningful rewards. Understanding how these systems operate allows you to make more informed financial decisions and enjoy various perks.

Key Advantages of Credit Card Reward Programs

- Cashback Offers: Many credit cards offer cashback rewards, which can range from 1% to 5% based on the categories of purchases you make. For example, a card might give you 3% cashback on groceries, 2% on gas, and 1% on all other purchases. If you spend $500 a month on groceries, that’s $15 back in your pocket, which can be accumulated and spent on future purchases or applied to your credit card bill.

- Travel Rewards: Accumulating points that can be redeemed for flights, hotel stays, or rental cars is another attractive feature of credit card rewards. For instance, many cards allow you to earn points for every dollar spent, which can then be used for free travel. This means that a family trip to a destination like Banff might become much more affordable, sometimes allowing for flights or hotel accommodations entirely on points.

- Exclusive Discounts: Credit card reward programs often include exclusive offers from partner retailers. For instance, a card might offer temporary promotions such as 10% off at your favorite clothing store, or access to exclusive sales events. This can provide substantial savings, especially during the holiday season when shopping expenses can quickly add up.

Moreover, responsible credit card usage offers added financial benefits, such as improving your credit score. By consistently making payments on time and maintaining a credit utilization ratio below 30%, you not only enjoy the rewards but also establish a strong credit history. This can lead to lower interest rates on future loans, further enhancing your financial health.

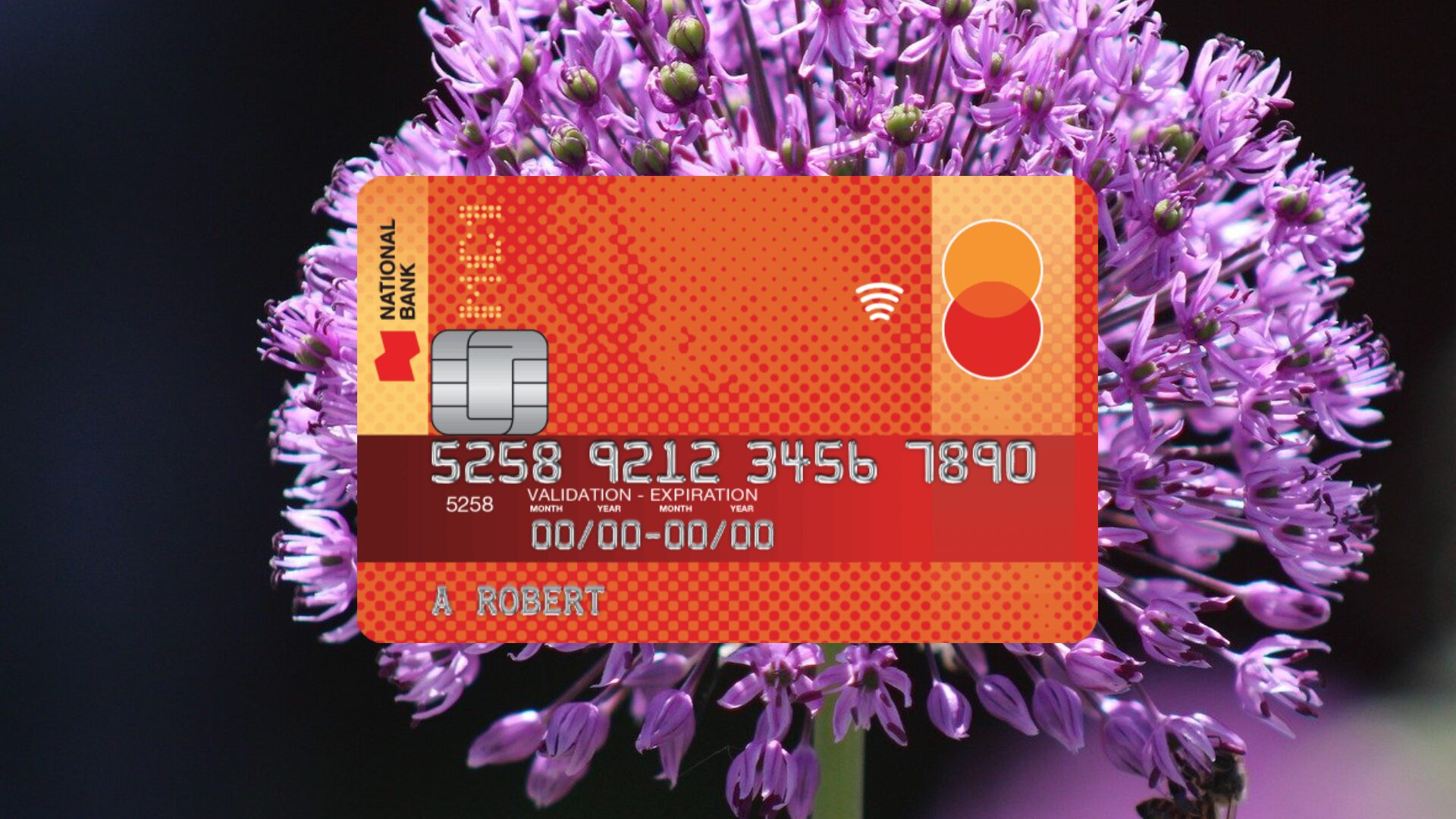

Tailored Options Available in Canada

In Canada, a diverse array of credit cards is available, each featuring specific reward programs designed for different lifestyles and spending habits. For example, if you frequently dine out, you may want to consider a card that offers heightened rewards on food purchases. Additionally, those who travel often can take advantage of cards that provide bonus points for travel-related expenses. Understanding these options is crucial for optimizing your rewards experience and ensuring that you select the card that best fits your lifestyle.

Ultimately, navigating credit card reward programs can lead to significant financial rewards when approached with careful consideration and responsibility. By choosing the right card and leveraging its benefits effectively, you can transform your everyday spending into a rewarding financial experience while building a strong credit foundation.

DISCOVER MORE: Click here to learn about the EdTech revolution

Unlocking Financial Benefits Through Credit Card Rewards

Credit card reward programs provide a plethora of opportunities for consumers looking to get the most out of their everyday spending. By understanding the different types of rewards available, you can tailor your credit card usage to your spending habits and reap the benefits effectively. Let’s look deeper into some specific advantages that these reward programs offer.

Variety of Reward Structures

One of the primary motivations behind credit card reward programs is the variety they offer. Each program comes with its unique structure allowing you to earn rewards in different ways. Some common types of rewards include:

- Points Systems: Many credit cards operate on a points system, where users accumulate points for each dollar spent. These points can be redeemed for a range of options, from merchandise to experiences like concert tickets. For instance, if you have a card that offers 2 points per dollar spent and you purchase a $100 item, you’ve already earned 200 points.

- Tiered Rewards: Some credit cards utilize tiered rewards based on spending categories. This means you might earn higher rewards for certain purchases, like dining and travel. For example, a card may offer 3% back on dining but only 1% on all other purchases, allowing you to maximize your rewards during social outings.

- Bonus Offerings: Many credit card companies sweeten the deal by providing bonus opportunities for new customers. This might include earning extra points after spending a specific amount within the first few months of opening your account. This can be an attractive incentive for those planning larger purchases shortly after obtaining a new card.

By understanding these different structures, you can select a card that aligns with your spending habits for optimal benefit. For example, if you frequently eat out, a card offering enhanced rewards on dining could translate into significant savings over time. Likewise, if you travel often, seeking out cards with travel perks, such as earning points on airfare and hotel stays, could result in complimentary upgrades or free hotel nights.

Maximizing Your Rewards

To fully take advantage of credit card rewards, you should also consider the strategies to maximize your benefits. This includes keeping track of your spending categories to ensure you’re utilizing the card effectively in the areas that yield the greatest rewards. Many users may not realize that their grocery purchases or other regular expenses can return considerable rewards if managed properly. By consistently using your rewards card and monitoring the rewards structure, you can amplify the benefits significantly.

In conclusion, credit card reward programs are a powerful tool for those willing to navigate their options thoughtfully. By understanding the variety of reward systems and implementing strategic usage, individuals can enhance their financial well-being and turn routine spending into substantial savings and rewards.

DISCOVER MORE: Click here to delve deeper

Enhancing Lifestyle Through Credit Card Rewards

In addition to the fundamental financial advantages, credit card reward programs can significantly enhance your lifestyle, providing not just savings but also enriching experiences. Understanding how to leverage these programs can lead to remarkable benefits, whether through savings on travel, dining, or entertainment. Let’s examine a few more compelling aspects of credit card rewards that can transform your everyday life.

Travel Perks and Benefits

For many consumers, one of the biggest draws of credit card rewards is the travel benefits they can provide. Travel-oriented credit cards often offer rewards specifically tailored to travelers, such as:

- Airline Miles: Many cards allow you to earn airline miles for each dollar spent. These miles can accumulate over time, ultimately leading to free flights or upgrades. For instance, you might earn enough miles from everyday purchases to book a round-trip flight to another province, or even internationally.

- Travel Insurance: Several credit cards come with travel insurance as part of their rewards program. This can include coverage for trip cancellations, lost luggage, and even emergency medical assistance. Depending on your travel frequency, this can save you potentially hundreds of dollars in insurance fees.

- Exclusive Airport Lounge Access: Some premium credit cards offer complimentary access to airport lounges around the world. This perk can enhance your travel experience, providing a comfortable space to relax before your flight with amenities like complimentary snacks and Wi-Fi.

Whether you are a frequent flyer or someone who only travels occasionally, these benefits can add significant value, turning your explorations into financially savvy adventures.

Cash Back Opportunities

Another appealing feature of many credit card reward programs is the cash back option. This program allows cardholders to earn a percentage of their spending back as cash, which can be credited toward their balance or deposited into a bank account. Here are some things to consider:

- Everyday Expenses: Regular expenditures such as groceries, gas, and utility bills can earn you cash back when you use a credit card designed for this purpose. For example, if you earn 2% cash back on a $200 grocery shopping trip, that adds up to a $4 return simply for using the right card.

- No Annual Fees for Smart Users: While many cash back credit cards do have annual fees, it’s possible to find no-fee cards with competitive cash back rates. For Canadians who wish to avoid extra costs, these options can yield significant savings without the burden of a yearly payment.

- Flexible Redemption Options: Cash back can often be redeemed in various ways, from statement credits to gift cards for popular retailers. This flexibility allows you to choose how you want to use your rewards, ensuring they are beneficial for your specific lifestyle.

Cash back credit cards can be particularly appealing for consumers who prefer straightforward rewards programs without the complications of points systems, allowing them to enjoy tangible returns on their purchases.

Building Credit and Financial Discipline

Engaging with a credit card rewards program can also help you build and maintain a healthy credit score. As you regularly use your card for purchases, timely repayments demonstrate responsible financial behavior. Here are a couple of ways reward programs contribute to credit health:

- Encouraging Responsible Spending: When you use a credit card wisely, only charging what you can afford to pay off each month, it promotes good financial habits. This can lead to better budgeting skills and an overall more informed approach to spending.

- Improving Your Credit Score: Using credit responsibly can help boost your credit score, which in turn can lead to better interest rates on loans and additional credit opportunities down the line. Higher scores make you a favorable candidate for mortgages or car loans, often saving you significant amounts on interest over time.

Ultimately, credit card rewards programs offer far more than just points and bonuses; they can enhance your overall financial health while improving your lifestyle seamlessly. By utilizing these features, savvy consumers can not only achieve savings but also create enriching experiences without the stress of overspending.

DISCOVER MORE: Click here to enhance your budgeting skills

Conclusion

In conclusion, credit card reward programs present an array of benefits that extend beyond simple financial incentives. By understanding how to effectively navigate and utilize these programs, you can unlock opportunities for substantial savings and enriching experiences that enhance your daily life.

From earning travel perks that provide access to free flights, upgrades, and additional protections while traveling, to benefiting from cash back opportunities on your everyday purchases, these rewards can be a powerful tool in your financial toolkit. Additionally, regular engagement with your credit card can facilitate the development of responsible spending habits and positively impact your credit score, laying the groundwork for financial stability and future opportunities.

However, it is crucial to approach credit card use with mindfulness. To reap the maximum benefits, ensure that you maintain disciplined spending patterns and always pay off your balance on time. This approach not only allows you to enjoy the rewards but also promotes financial health in the long run.

Ultimately, credit card reward programs are much more than just a means to earn points; they can enhance your overall lifestyle and result in significant savings if managed wisely. Whether you’re a traveler at heart or simply looking to optimize your household expenses, these programs can bring value to your financial journey.