3% cash back on groceries at U.S. supermarkets (up to $6,000 per year in purchases, then 1%)

2% cash back at U.S. gas stations and select U.S. department stores

No annual fee

$100 statement credit after spending $2,000 in purchases within the first 6 months

You will continue to explore our website

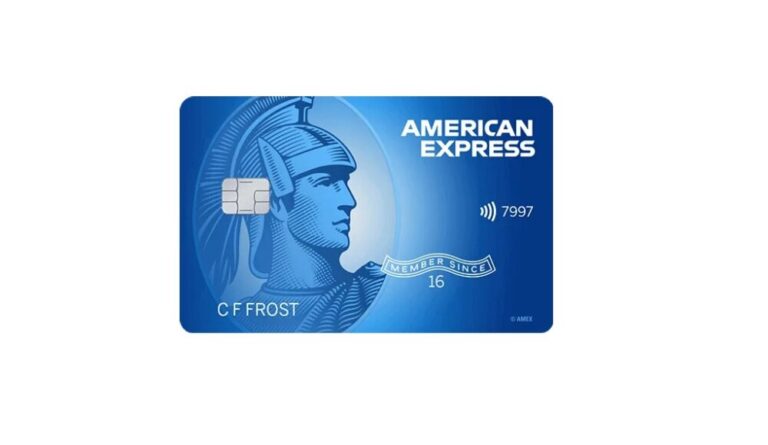

Introducing the American Express Blue Cash Everyday Credit Card, the perfect companion for savvy shoppers in the United States. With this card, you'll earn cash back on everyday purchases like groceries and gas, making it an ideal choice for routine expenditures. Enjoy fantastic rewards without the burden of an annual fee, ensuring more savings in your wallet. Start maximizing your spending power today with the card tailored for your everyday life, making those daily trips to the store more rewarding than ever.

The American Express Blue Cash Everyday Credit Card provides a 3% cash back on groceries at U.S. supermarkets.

This benefit allows families to save significantly on their monthly grocery bills.

For example, if a household spends $500 monthly on groceries, they can earn $15 in cash back.

Over a year, this totals up to $180 in savings.

Such savings can be reallocated to other expenses or put into a savings account for future needs.

Once the $6,000 annual limit is surpassed, cardholders still earn 1% cash back.

This ensures constant value and savings every time they shop for groceries.

With 2% cash back at U.S. gas stations, this credit card supports those frequently on the road.

For a family driving 12,000 miles a year, spending roughly $1,500 on gasoline, the cash back amounts to $30 annually.

This can make a significant difference in everyday commuting or travel expense management.

Additionally, users get 2% cash back at select U.S. department stores.

This means when purchasing clothes or household goods, a discount is effectively applied, reducing overall spending.

These rewards combine to bolster household savings and alleviate budget pressures for many families.

You will continue to explore our website

One of the standout cost-saving features of the American Express Blue Cash Everyday Credit Card is its no annual fee policy.

This means you can enjoy all the benefits of the card without worrying about a yearly charge eating into your savings.

For instance, if a card typically charges a $95 annual fee, opting for a no-fee card like this one allows you to save that amount each year.

That money can be redirected towards groceries, utility bills, or even savings.

Over time, not paying an annual fee can make a significant difference to your financial bottom line, helping you allocate funds more effectively.

The American Express Blue Cash Everyday Credit Card offers a valuable $100 statement credit after spending $2,000 in the first six months.

This incentive effectively reduces your total spending by $100, serving as a direct saving on your bill.

Think of it like getting a $100 discount simply by using the card for your everyday expenses such as groceries, gas, or dining.

It's a strategic way to save money on things you already plan to purchase.

Meeting the spending requirement with planned purchases ensures you don't overspend while still receiving the bonus credit.

Linda Carter is a writer and financial consultant specializing in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, Linda provides practical analyses and guidance on the Dicas da Andy platform. Her goal is to empower readers with the knowledge needed to achieve financial success.